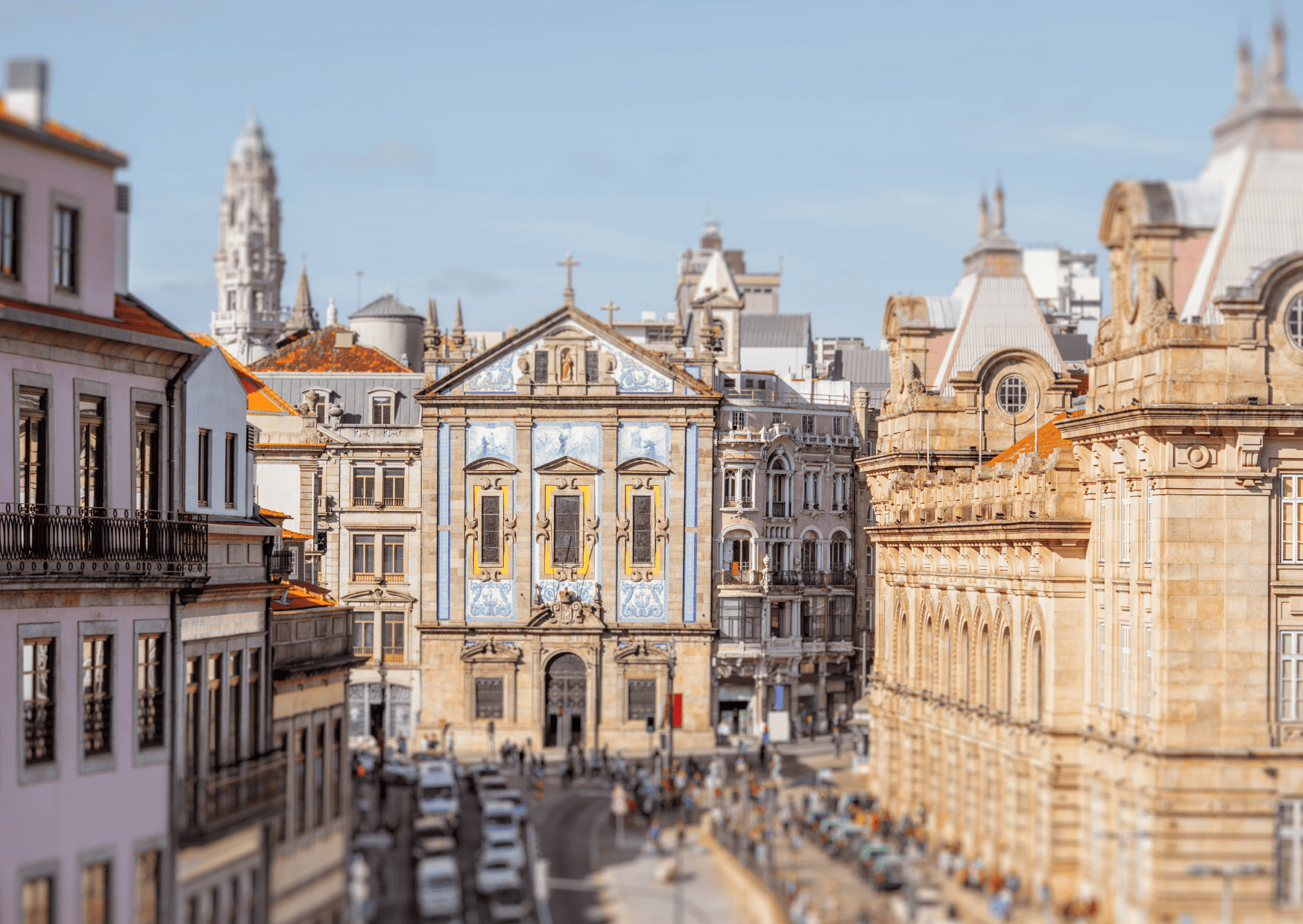

Porto just changed their property laws and Americans are about to discover what Europeans have been hiding: you can buy an actual apartment in a European city for less than a Tesla. Not a ruin. Not a timeshare. A real apartment where you can live, rent out, or sell tomorrow.

The new “Reabilitar para Arrendar” program is practically begging foreigners to buy abandoned properties. They’ve streamlined everything – taxes, permits, bureaucracy – because Porto is full of empty buildings and they need bodies and money. Americans spending $500,000 on a condo in Phoenix have no idea they could own five apartments in Portugal instead.

Quick and Easy Tips

Research eligibility and verify whether the low-cost purchase requires renovation commitments, permits, or approval from local urban authorities.

Consult a local real estate lawyer to understand ownership rights, property restrictions, and tax implications before signing any agreement.

Visit the neighborhood in person to assess renovation needs, community dynamics, and the actual cost of restoring the property.

The rise of affordable property purchases in Porto has sparked debate, especially as Americans discover that certain local housing laws make low-cost acquisitions possible. Supporters of this trend argue that restoring older buildings through regulated frameworks benefits local neighborhoods. They see it as a practical solution for revitalizing historic districts while attracting investment and preserving cultural heritage. Critics counter that these opportunities can create uneven advantages for foreign buyers, especially when locals struggle to access similar deals due to financing limitations or bureaucratic barriers.

Another point of controversy involves whether foreign buyers truly understand the obligations tied to low-cost property schemes. While €50,000 price tags are attention-grabbing, these deals often involve restricted purchasing zones, renovation requirements, or limitations on resale. Some locals express concern that the sudden wave of interest is fueled more by viral headlines than by genuine awareness of the urban renewal goals behind the law. This disconnect between perception and reality has fueled discussions about transparency in property marketing.

There is also disagreement regarding the long-term impact on Porto’s housing market. Advocates believe that international interest can inject resources into neighborhoods that have been overlooked, creating jobs, improving infrastructure, and restoring historic architecture. Opponents fear that a surge of foreign buyers could slowly change the character of local communities and raise demand in adjacent markets, even if the initial properties are low-cost. This debate reflects broader European concerns about balancing growth with cultural preservation.

The Law Change Nobody’s Talking About

October 2024, Portugal quietly adjusted property regulations for foreign buyers. Previously, non-EU citizens needed golden visa investments (€500,000 minimum) or jumped through bureaucratic hell. Now? If the property needs renovation and you commit to it, restrictions basically disappear.

The program specifics:

- Properties under €150,000 qualify

- Must renovate within 3 years

- Can rent immediately (no restrictions)

- Reduced IMT (transfer tax) from 7.5% to 2%

- VAT on renovations dropped to 6%

- No minimum investment requirements

- No residency requirements

Porto has 12,000 empty apartments. The government would rather Americans buy them for €50,000 than let them rot empty. It’s that simple.

What €50,000 Actually Buys

Cedofeita (trendy area): 1-bedroom apartment, 55m², needs kitchen and bathroom update, balcony, second floor, rental potential €800/month

Bonfim (up-and-coming): 2-bedroom, 70m², needs everything but has original tiles and high ceilings, could rent for €1,000/month after renovation

Campanhã (still rough but changing): 3-bedroom, 95m², needs total renovation, but three bedrooms in a European city for €45,000

These aren’t ruins. They’re apartments where grandma died in 2015 and the family can’t agree what to do. They need updating – new kitchen, bathroom, maybe electrical. But the bones are solid. These buildings survived 200 years; they’ll survive another 200.

The Rental Math That’s Embarrassing

Porto apartment: €50,000 purchase + €20,000 renovation = €70,000 total investment Rental income: €800/month = €9,600/year Return: 13.7%

Austin condo: $500,000 purchase Rental income: $2,500/month = $30,000/year Minus HOA, taxes, insurance: $20,000/year net Return: 4%

Porto beats Austin by 3x. With 1/7th the investment. In Europe. With Portuguese residency possibilities.

Americans are getting 4% returns on half-million dollar investments while Portuguese properties return 12-15% on €50,000 investments. The math is stupid but real.

How the Renovation Scam Actually Works

Everyone warns about Portuguese contractors. They’re right and wrong. Yes, they’re slow. Yes, they’ll disappear for saint’s days you’ve never heard of. But they’re also cheap if you know the system.

Kitchen renovation:

- American quote: $35,000

- Portuguese quote: €8,000

- Portuguese reality: €6,000 if you buy materials yourself

Bathroom renovation:

- American quote: $25,000

- Portuguese quote: €5,000

- Reality: €3,500 with metro tiles instead of imported

Full apartment (70m²):

- American quote: Would be $120,000

- Portuguese quote: €25,000

- Reality: €20,000 if you’re not stupid

The secret? Portuguese contractors quote high to foreigners who want “American standard” (meaning unnecessary luxury). Want Portuguese standard? Prices drop 40%.

The Bureaucracy That’s Actually Fixed

Old Portugal: 18 months for a renovation license, 47 documents, three lawyers, maybe approval, probably not.

New Porto program: 60-day maximum for renovation approval. One office. One person assigned to your case. They WANT you to succeed because every renovated apartment increases property tax revenue.

The municipality even provides:

- Free architectural consultation

- List of approved contractors

- Tax incentive paperwork

- Rental license fast-track

They’ve assigned English-speaking staff because they know foreigners have money but no Portuguese. It’s the most un-Portuguese thing Portugal has ever done, and it’s working.

What’s changed

In Portugal, residents are taxed on their worldwide income, and in 2025 the personal income tax brackets for residents now range from about 12.5% up to 48% (depending on income) plus solidarity surcharges.

The previous flagship regime, the NHR (Non-Habitual Resident) status, allowed many new Portuguese tax residents to enjoy favourable tax treatment on foreign-source income (dividends, interest, capital gains, pensions) under certain conditions.

That regime has been phased out for most new applicants and replaced by the IFICI programme. Under IFICI (often described as “NHR 2.0”), only individuals who qualify (principally via “highly qualified professions”, innovation or research roles, or certain strategic activities) may benefit from special tax treatment.

Among the changes is the fact that foreign-sourced income such as pensions, dividends, and capital gains are now more tightly controlled and often taxed at the regular resident rates unless covered by a double tax treaty or other specific exemption.

The Neighborhoods to Buy Before They Explode

Campanhã: Everyone says it’s dangerous. It’s not. It’s poor. Big difference. Metro station, 15 minutes to center, properties at €40,000. Will be €100,000 in five years.

Bonfim: Already gentrifying but still affordable. Artists and young Portuguese moving in. €50,000-70,000 now, probably €150,000 by 2027.

Cedofeita: Was trendy, now established, but still properties under €100,000 if you look above third floor or accept no elevator.

Paranhos: University area, constant rental demand, parents buying for kids means prices rising. €60,000 gets you guaranteed student rentals forever.

Aldoar: Beach adjacent, locals only, no tourists yet. €55,000 for apartment 20 minutes from ocean. When the metro extends (2026), prices double.

The Americans Already Doing This

Met Jennifer from California. Bought three apartments in 2023 for €180,000 total. Renovated with basic Portuguese finishes. Now renting all three for €2,400/month combined. Lives in one for free, profits €1,600/month, has Portuguese residency.

Tom and Patricia from Texas bought a building. Entire building. Six apartments for €220,000. Renovating one at a time. Living in top floor, renting others. Will net €4,000/month when complete. Less than they paid for their Houston house that generates nothing.

David from New York bought sight unseen (insane but worked). €45,000 for Campanhã apartment. Spent €15,000 on renovation. Rents for €700/month. Flying visit twice a year, property manager handles everything. “Better than my stocks,” he says.

The Property Manager Reality

Everyone warns about Portuguese property management. They charge 20-25%. In America, they charge 10%. Seems bad until you realize:

Portuguese managers:

- Deal with all bureaucracy

- Handle all repairs

- Manage utilities

- File your taxes

- Find tenants

- Navigate rental laws

- Translate everything

For €150/month on a €700 rental. Try getting that service in America for any price.

The Residency Bonus Nobody Explains

Buy property in Portugal, even €50,000 property, and you can apply for residency. Not automatic, but property ownership makes everything easier.

D7 visa (passive income): Property rental counts as income Golden visa: Dead for expensive properties but cheap properties + renovation might qualify under new rules Digital nomad visa: Property ownership shows “connection to Portugal”

After five years residency: Permanent residency After six years: Portuguese citizenship After citizenship: EU passport, live anywhere in Europe

Americans paying migration lawyers $50,000 for residency consulting when buying a €50,000 apartment accomplishes the same thing.

The Rental Laws That Actually Favor Landlords Now

Old Portugal: Couldn’t evict anyone ever. Tenants had rights to stay forever at 1980s rents. Disaster for landlords.

New law (2023):

- Can evict for non-payment in 3 months

- Contracts can be fixed-term

- Rent increases allowed with inflation

- Airbnb legal with simple registration

- Long-term rentals get tax breaks

Portugal realized nobody would invest if tenants could squat forever. Changed everything. Now landlords have actual rights. Revolutionary for Portugal.

The Financing Secret

Portuguese banks won’t lend to non-resident Americans. Everyone knows this. What they don’t know: Portuguese sellers will.

Traditional Portuguese property deals include “vendor financing.” Seller accepts 50% now, 50% over 2-3 years. No bank involved. Normal, legal, common.

Found properties with:

- €25,000 down, €25,000 over 24 months

- €10,000 down, €500/month for 5 years

- €30,000 down, balance when you want

Why? Sellers are often families who inherited property. They’d rather have steady money coming than lump sum taxed at 28%. You get financing without banks. Everyone wins.

The Tax Situation That’s Beautiful

Portugal’s NHR (Non-Habitual Resident) program: 10 years of tax benefits.

Foreign income: Often 0% tax Rental income: Flat 20% tax (not marginal rate) Capital gains: 0% after two years if you buy another property Property tax: €200-400 yearly for €50,000 apartment

Compare to America where you’re paying $8,000 property tax on a $500,000 house plus income tax on rentals plus capital gains when you sell.

The Mistakes Americans Make

Trying to make Portuguese properties American. Installing American kitchens. Central air conditioning (nobody has it, nobody needs it). Open floor plans (Portuguese hate them).

A basic Portuguese renovation costs €15,000 and rents immediately. An American-standard renovation costs €40,000 and rents for the same price. Portuguese tenants don’t care about your SubZero refrigerator.

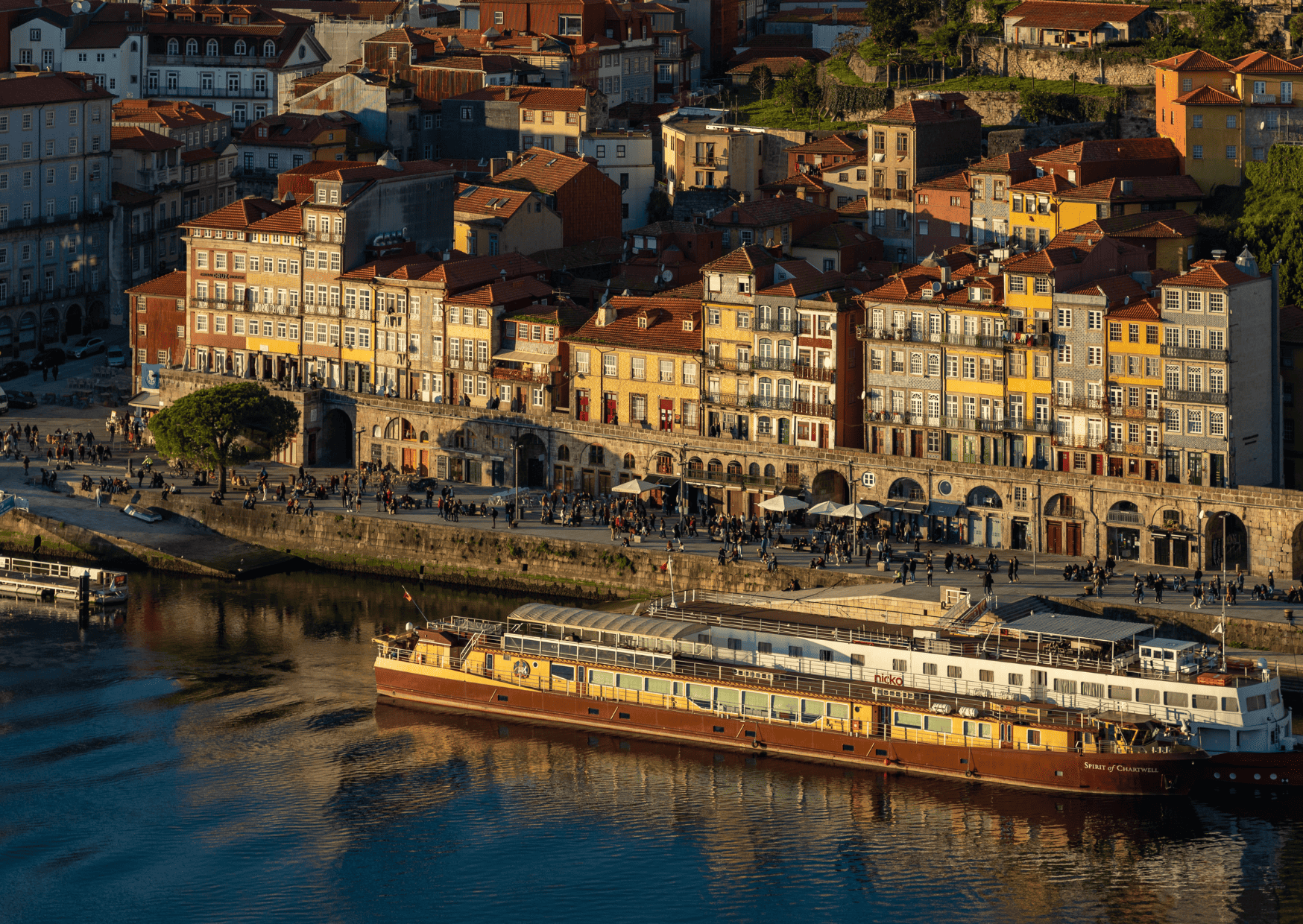

Buying in tourist areas. Baixa and Ribeira are tourist Disney. Expensive, seasonal rentals, competition from every property. Buy where Portuguese people actually live. Steady rentals, normal prices, actual neighborhoods.

Using American lawyers. Portuguese property law isn’t complex. You need a Portuguese lawyer who does 50 transactions monthly, not an American lawyer who googles Portuguese law. Cost difference: €500 vs $5,000.

The Construction Gold Mine

Portugal needs 200,000 construction workers. Can’t find them. If you can swing a hammer, you can renovate your own properties and others’.

Americans with basic construction skills are making €100/hour consulting on renovations. Portuguese contractors make €15/hour. Guess who desperate foreign buyers hire?

One guy from Oregon came to flip one house. Now runs renovation business. Makes more than he did in Portland. Works less. Lives by the ocean.

The Insurance and Utilities Paradise

Property insurance: €150/year for €50,000 apartment Utilities: €50/month average Property management: €150/month Total carrying costs: €250/month

American condo fees alone are often $500/month. Before insurance. Before utilities. Before anything.

Porto property costs less to own empty than American HOA fees.

The Loopholes for Multiple Properties

Portugal limits non-EU buyers in certain zones. But:

- No limits on how many properties under €150,000

- No limits in “urban rehabilitation areas” (most of Porto)

- No limits if you have a Portuguese company (costs €500 to create)

- No limits after getting residency

Americans creating Portuguese LLCs (called “Unipessoal”), buying 10 properties, renovating slowly, building rental empires. All legal. All encouraged. Porto wants renovation, doesn’t care how it happens.

What Happens in Five Years

Porto is following Lisbon’s trajectory but 5-7 years behind. Lisbon apartments that cost €50,000 in 2015 are now €200,000. Porto is at 2015 Lisbon prices.

The metro is expanding. The airport is expanding. Tech companies are arriving. Every indicator suggests massive appreciation. But Americans are buying in Austin and Nashville instead.

€50,000 Porto apartment today = €150,000 in 2028 $500,000 Austin condo today = $550,000 in 2028 (maybe)

Which math do you prefer?

The Daily Reality of Porto Property

Winter: Mild, rainy, buildings are stone so they’re cold. €50 monthly heating. Summer: Perfect, no AC needed ever, windows open, ocean breeze. Neighbors: Old Portuguese people who bring you soup. Noise: Church bells, seagulls, occasional drunk tourist. Safety: Safer than any American city. Walkability: 100%. No car needed ever.

Your property exists in a functional city with public transport, healthcare, safety, and culture. Not a suburban wasteland requiring cars for everything.

The Exit Strategy

Can’t stand Portugal? Sell to another American. They’re arriving daily. Love Portugal? Get residency, citizenship, keep buying. Need money? Sell one property, keep others. Want to travel? Property manager handles everything.

Portuguese property is liquid. Always buyers. Especially under €100,000. Especially renovated. Especially with rental income established.

Unlike American property that sits on market for months, Porto properties under €100,000 sell in days. Cash buyers everywhere.

The Website Nobody Reads

Idealista.pt – Portugal’s main property site. In Portuguese but Google translates. Everything is there. Thousands of properties under €50,000.

Portuguese ignore these properties because they’re work. Americans don’t know the site exists. The gap between these facts is your opportunity.

Filter: Porto, max €50,000, apartment. Results: 847 properties (as of today) Reality: 847 opportunities Americans don’t know exist

The Support System

Porto municipality has a “foreign investor desk.” They speak English. They want you to succeed. They’ll hold your hand through everything. Free.

Facebook groups: “Americans in Porto,” “Porto Property Investors,” “Portugal Property Forum.” Hundreds of people who’ve done this. They share contractors, lawyers, tips. Nobody’s competing because there are 12,000 empty properties.

Local expat community: Americans, Brits, Germans, French. Everyone helps everyone because everyone wants Porto to succeed. Your success raises their property values.

The Final Math

Option A: $500,000 Austin condo, $3,000/month costs, 4% returns, no residency, no Europe

Option B: Five €50,000 Porto apartments, €1,250/month costs, 13% returns, Portuguese residency, EU future

Option C: Do nothing, keep renting, complain about property prices

Porto is offering Americans the chance to buy property for less than a car. In Europe. With rental income. With residency possibilities. With 3x better returns than American property.

The program exists. The properties exist. The support system exists.

The only thing missing is Americans who can read Portuguese property law changes and do basic math.

€50,000. Apartment. Europe. 13% returns.

While Americans fight over million-dollar shacks in California.

Porto doesn’t care if Americans don’t come. They’ll sell to the French and Germans instead.

But the opportunity is there. Right now. Today.

Idealista.pt.

€50,000.

Porto.

Your move.

The property laws in Porto offering homes at accessible prices reflect a creative strategy for urban renewal rather than a simple discount for foreign buyers. Understanding the purpose behind these opportunities helps buyers appreciate the connection between heritage preservation and affordable real estate. While the initial number may seem like a bargain, the true value lies in participating responsibly in the revitalization of historic neighborhoods.

For Americans exploring this opportunity, the key is approaching the process with realistic expectations and careful planning. Low purchase prices often come with obligations that involve time, effort, and financial investment beyond the initial amount. Those who are prepared for restoration work and patient with local regulations are more likely to benefit from both the cultural and financial rewards of owning property in Porto.

Ultimately, the appeal of this law goes beyond affordability. It represents a chance to be part of a city where history, architecture, and modern living are deeply intertwined. Buyers who respect the context and contribute positively to local communities can find a rewarding experience that is very different from traditional property investment. The €50,000 headline may spark curiosity, but the real value comes from understanding the story behind it.

About the Author: Ruben, co-founder of Gamintraveler.com since 2014, is a seasoned traveler from Spain who has explored over 100 countries since 2009. Known for his extensive travel adventures across South America, Europe, the US, Australia, New Zealand, Asia, and Africa, Ruben combines his passion for adventurous yet sustainable living with his love for cycling, highlighted by his remarkable 5-month bicycle journey from Spain to Norway. He currently resides in Spain, where he continues sharing his travel experiences with his partner, Rachel, and their son, Han.