A friendly, side-by-side look at how the U.S. turns one number into a mortgage gatekeeper, while most European lenders still judge you by pay stubs, bank habits, and national rules. Current as of September 2025.

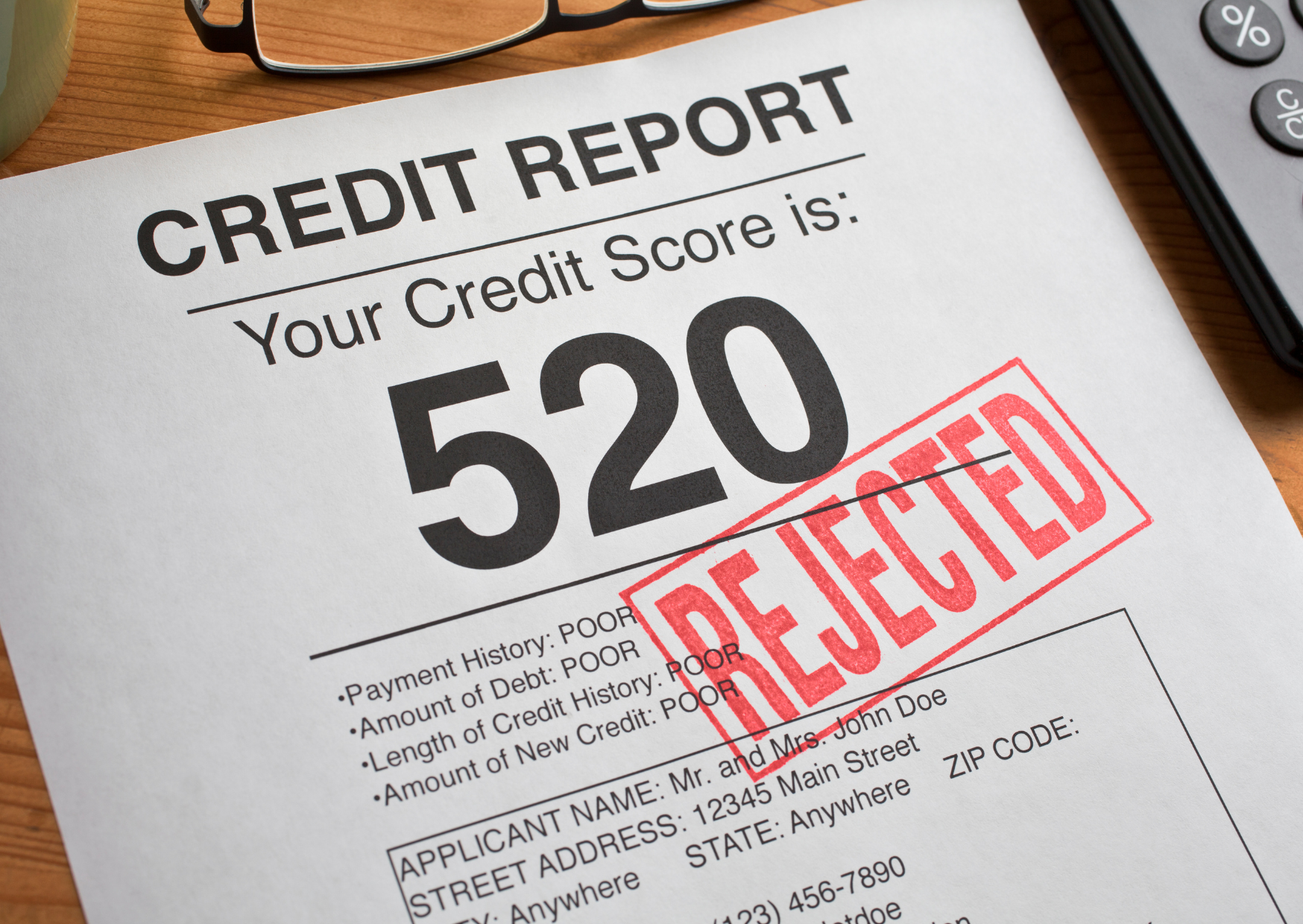

You sit down with a U.S. lender and they ask for your credit score before they ask your name. The number is the room key. Above a line, doors swing open. Below it, they do not.

Cross the Atlantic and the conversation changes. A French banker wants salary slips and a debt ratio. A Dutch adviser checks a national credit register. A German bank pulls Schufa, then runs a tight affordability test. Ask about your “FICO” and you will get a polite shrug.

This guide decodes both worlds. What the U.S. actually requires by score. How European lenders approve people who have never seen a three-digit number on a dashboard. Where the systems overlap. And how to translate your American file into something a European bank understands.

Want More Deep Dives into Everyday European Culture?

– Why Europeans Walk Everywhere (And Americans Should Too)

– How Europeans Actually Afford Living in Cities Without Six-Figure Salaries

– 9 ‘Luxury’ Items in America That Europeans Consider Basic Necessities

How The U.S. Mortgage Thresholds Really Work

America’s mortgage market runs on credit scoring as the first pass. The most common model is FICO, which ranges from 300 to 850. Lenders price risk and eligibility off that range, then layer on income, assets, and the property itself. In practice, you will hear four program “floors” more than any others:

- Conventional loans backed by Fannie Mae or Freddie Mac generally want a 620 minimum credit score. That is the line most borrowers hear from banks and brokers when they ask about a mainstream, low-friction loan. Program manuals and eligibility matrices spell out the floor, with exceptions only in narrow cases.

- FHA loans are designed for thinner or bumpier files. The headline minimum is 580 to qualify for 3.5 percent down. Scores between 500 and 579 can still be eligible, but expect 10 percent down and tighter underwriting.

- VA loans for eligible veterans and service members are unusual in a good way. The VA itself does not set a program-wide minimum. Many lenders still use 620 as their internal line, but the rule comes from the lender, not from VA policy.

- USDA guaranteed loans for eligible rural borrowers often treat 640 as the score where automated approvals get smooth. Below that, lenders can still manually underwrite with extra documentation.

Those floors are not every lender’s exact policy, but they are the national patterns most borrowers face when they ask for a number. Your rate and fees then move with your score, your down payment, and the rest of your profile.

What to notice if you are new to U.S. mortgages: the number comes first. In many cases, the loan officer will not start a full conversation until they see your score and tri-merged reports. Improving the number can be the difference between approval and a hard stop.

Why Europeans Don’t Start With A Score

Most European mortgage systems do not use a universal, consumer-facing credit score the way the U.S. does. Banks still check your history, but they do it through national registers, bank statements, and program rules that center on affordability rather than a single three-digit gatekeeper. A few quick portraits:

- France. The rule you hear first is effort ratio 35 percent max and max term 25 years. Lenders look at stable income, permanent contracts, and your existing payments. There is no national FICO-style score handed to you at the teller window. If your numbers fit the rule, you can be approved even if you have never tracked a “credit score” in your life.

- The Netherlands. Lenders must check the BKR credit register. BKR is not a consumer score. It is a registry of your credit and payment history that flags active debts and issues. Dutch affordability models then decide how much you can borrow, often with public guardrails like NHG limits and income tables.

- Germany. Banks pull Schufa, a private credit agency that produces a score and detailed file. It is influential, but it is not a U.S.-style universal mortgage gate on its own. German banks still run strict debt-to-income tests and employment checks. If income or job status fails, a high Schufa score will not save the file.

- Spain. Lenders consult CIRBE, the Bank of Spain’s risk register. It aggregates your loans and guarantees across institutions. It is not a consumer “points” score. Banks judge you on income stability, debt load, and banking history.

- United Kingdom. There are credit reference agencies and credit scores, but there is no single FICO number. Lenders use their own internal scorecards with data from Experian, Equifax, and TransUnion. If you move from the U.S., a lender might glance at your American reports, but you will still need to build U.K. credit files and, more importantly, meet affordability tests.

Zoom out and the European theme is simple: prove you can afford the loan under national rules. The EU’s Mortgage Credit Directive requires a formal creditworthiness assessment that cannot rely mainly on the home’s value. It does not tell banks to approve or deny based on one consumer score.

Where The Systems Overlap

Even though the front door is different, the back room looks familiar on both sides of the Atlantic.

- Debt ratios matter. The U.S. uses DTI guidelines inside each program. France codifies 35 percent as the general ceiling with limited exceptions. Many European supervisors publish affordability expectations that lenders treat as hard rails.

- Employment stability carries weight. U.S. lenders verify two years of history and current status. European lenders place similar weight on permanent contracts, probation periods, and fixed income.

- Down payment helps. Bigger down payments reduce risk in any system. They can offset a thinner U.S. scorecard or a tighter European affordability result.

- Data sharing is tightening. Europe has national registers. The U.S. has three big credit bureaus. Both regions keep nudging lenders toward more accurate, more recent data when they assess borrowers.

The Real U.S. Numbers, Plainly

If you are trying to buy in the States, here is the clean version of what those program floors mean in life:

- At 620 and up, you are in prime territory for most conventional files, assuming income and property line up.

- At 580 and up, you can reach for FHA with 3.5 percent down.

- At 500 to 579, FHA is still possible with 10 percent down, but lenders will examine the rest of your file closely and not all lenders participate at this tier.

- For VA, the program does not set a minimum, but most lenders look for 620. Strong compensating factors can help if you are below that line.

- For USDA, 640 is the common line where automated systems smile. Below 640, manual underwriting can keep a file alive if the rest of the picture is strong.

Rates and fees improve as your score improves, especially around 680, 700, 740, and 760+ breakpoints that many lenders use to price loans.

What A European Underwriter Actually Checks

Imagine you are applying in Paris, Amsterdam, or Munich and you have never tracked a credit score. The lender will still ask for a lot, just not a number.

- Income package. Recent pay slips, tax returns, and an employment contract that shows permanence and probation status.

- Debt profile. Monthly payments for existing loans or cards and what the national register says about your history. In France, that feeds the 35 percent effort ratio. In the Netherlands, BKR flags active credits. In Spain, CIRBE lists risk exposures across banks. In Germany, Schufa flags issues.

- Term and purpose. Many countries limit the maximum term. France uses 25 years in most cases. Some cap loan-to-income or loan-to-value in specific risk buckets.

- Buffer. Lenders like to see savings after completion. That cushion matters as much as cosmetics.

A Friendly Translation Guide For Americans In Europe

If you are moving your life to Europe and you have a tidy U.S. score, here is how to make it useful on the other side.

- Lead with affordability. Show clean debt ratios, a stable employment contract, and the cash you are bringing. That is what the underwriter must prove to their supervisor.

- Bring bank statements, not just a number. European lenders want to see your habits. Three to six months of statements that show rent paid on time, no unexplained overdrafts, and a clear savings pattern are worth more than a screenshot of 760.

- Expect a national register check. In the Netherlands, a healthy BKR record is the baseline. In Germany, Schufa is unavoidable. In Spain, CIRBE will show any significant loans already in your name.

- Do not get hung up on the score. Ask what the bank needs to approve you under its rules. If you can meet the country’s debt ratio and term, the absence of a U.S.-style consumer score is not a blocker.

- Mind the basics. Voter registration, local bank accounts, and utility bills in your name help your file in many countries because they stabilize identity and address history.

Country Snapshots You Can Use

A few practical one-pagers so you can picture the differences.

France

- Affordability: effort ratio 35 percent max in most cases, 25-year maximum term. Banks have a small quota for exceptions.

- What replaces a score: stable salary, job contract, bank statements, and clean national files.

- Good to know: discretionary life insurance and borrower’s insurance factor into costs and approval culture.

Netherlands

- Affordability: national models tied to income and energy performance, with NHG providing guarantees below set limits.

- What replaces a score: BKR registration check and a strict income test.

- Good to know: the negative impact of consumer loans is immediate because BKR flags everything.

Germany

- Affordability: banks often cap lending using conservative income multiples and careful job checks.

- What replaces a score: Schufa plus bank underwriting, with Schufa acting as a gatekeeper for prior issues, not a go-no-go on its own.

- Good to know: foreign buyers often need higher down payments and impeccable documentation.

Spain

- Affordability: income-based, with a close read of CIRBE to see existing obligations.

- What replaces a score: the national risk register and your documents.

- Good to know: your bank history matters more than a consumer number.

United Kingdom

- Affordability: lender-specific, regulated by the FCA.

- What replaces a score: internal lender scoring using data from Experian, Equifax, TransUnion, with heavy weight on income and outgoings.

- Good to know: your U.S. score does not transfer, but your habits do. Lenders may review U.S. reports in context.

Pitfalls Most Buyers Miss

Assuming a high U.S. score guarantees a European approval. It helps your story, but affordability and national registers decide the file. A spotless 780 with a too-high debt ratio still fails in France.

Thinking Europe has no credit data. It does. It is just organized differently. BKR, Schufa, and CIRBE are powerful. They are not the same as a consumer score.

Ignoring term caps and national rules. A lender may like your profile but still must keep you within a 25-year term in France or a specific income cap in the Netherlands. The rules are structural.

Chasing a U.S. program rule in a country that does not use it. There is no FHA in Munich, no VA in Lyon, and no USDA in Valencia. Bring the discipline, not the acronym.

Forgetting that lenders add their own overlays. The VA does not set a minimum score, but many VA lenders use 620 anyway. The same happens in Europe with internal risk policies.

The Practical Playbook

Here is a clean plan whether you are buying in Phoenix or Porto, Denver or Düsseldorf.

If you are buying in the U.S.:

- Pull your reports and scores from the three bureaus.

- If you are under 620, meet with a lender to map the FHA or VA path and what down payment or waiting periods you need.

- At 620 to 679, compare conventional and FHA side by side. Pricing may favor FHA at some tiers, but monthly mortgage insurance changes the math.

- At 680 and up, price conventional aggressively. Each 20-point step may drop your rate or fees.

- Keep a paper trail. Two years of W-2s, recent pay stubs, bank statements, and any letters of explanation.

If you are buying in Europe:

- Learn the national caps. If you are in France, plan on 35 percent effort ratio and 25 years. If you are in the Netherlands, run your case through a Dutch calculator that reflects this year’s income tables and energy adjustments.

- Build your local paper trail. Open a bank account, set up utilities in your name, and keep clean statements for three to six months.

- Check the registers. Ask a broker to pre-screen your BKR, Schufa, or CIRBE exposures so surprises do not kill the file.

- Save a bigger down payment than you think you need. It buys leverage in any system.

- Pick a lender that actually works with expats or cross-border files. Experience matters.

Regional And Seasonal Differences To Expect

- Rules move slowly, then all at once. France’s HCSF codified the 35 percent and 25-year pattern. The Netherlands adjusts NHG and affordability tables yearly. Germany’s Schufa is under pressure to be more transparent and is evolving.

- Rates change your ceiling. When rates fall, affordability rises without any score change. Watch national rate trends when planning your window.

- Registers can surprise you. A forgotten phone installment can appear in BKR. A small overdraft can leave a footprint. Clean up before you apply.

If You’re Running The Numbers

Let’s say you have $90,000 in cash and you are choosing between a U.S. purchase today and a European purchase next year. You want to know which path is mechanically open to you.

U.S. path, credit-score driven:

- With a 640 score, you can pursue FHA at 3.5 percent down on a modest purchase or conventional if the rest of the file is strong. Improving to 700 can materially lower your rate and fee load on a conventional loan, even if your income does not change.

- If you are at 590, FHA is still on the table with low down payment. If you are at 540, you will likely need 10 percent down and a lender that still works at that tier.

- VA-eligible buyers can clear a path at sub-620 with the right lender and compensating factors, but many will ask you to target 620 first.

European path, affordability-driven:

- In France, the question is simple. Is your effort ratio under 35 percent and is your term at or under 25 years. If yes, a clean file can be approved without any consumer score.

- In the Netherlands, pre-check your BKR and run your income through a 2025 affordability calculator. If the output says the purchase works, the bank is not going to deny you because you do not have a FICO.

- In Germany, make sure your Schufa has no negative flags and your job situation and down payment meet the bank’s internal policy. A strong Schufa and weak income will still fail. A clean Schufa and strong income can pass.

What to optimize in either world: steady job history, clean deposits, and a budget that leaves room after the payment. Those habits translate better than any score.

About the Author: Ruben, co-founder of Gamintraveler.com since 2014, is a seasoned traveler from Spain who has explored over 100 countries since 2009. Known for his extensive travel adventures across South America, Europe, the US, Australia, New Zealand, Asia, and Africa, Ruben combines his passion for adventurous yet sustainable living with his love for cycling, highlighted by his remarkable 5-month bicycle journey from Spain to Norway. He currently resides in Spain, where he continues sharing his travel experiences with his partner, Rachel, and their son, Han.