Our guide on the mistakes to avoid with your travel insurance and the best travel insurance for your next trip.

When planning your travels, securing the right travel insurance is essential to protect yourself from unforeseen events. To ensure comprehensive coverage and avoid common pitfalls, consider the following guidelines.

By carefully selecting a travel insurance policy that aligns with your specific needs and being mindful of these common mistakes, you can travel with greater peace of mind, knowing you’re well-protected against potential mishaps.

Read here Best eSim for International Travel and Best Travel Insurance Comparison

BOOK YOUR TRAVEL INSURANCE

Two of our favorite travel insurance: Heymondo Vs Safetwing cheapest travel Insurance. You can get for $135 USD your Heymondo Travel Insurance with Heymondo discount code valid for 90 days. Read our full comparison of Genki vs Safetywing Travel Insurance Review and the comparison Heymondo vs Genki

Quick & Easy Tips

Read the exclusions—many policies don’t cover extreme sports or pre-existing conditions.

Check coverage limits—especially for medical emergencies and evacuation.

Buy early—coverage for trip cancellation usually starts right after purchase.

Compare providers—look for consistently high customer service ratings.

Consider annual plans—they can be cheaper if you travel often.

Some travelers believe that travel insurance companies profit by making claims difficult to approve, using fine print and vague wording to avoid payouts. Critics see this as an industry problem that needs stricter regulation.

There’s also debate over whether travel insurance is even necessary for short, low-cost trips. Some argue that credit card perks or domestic health insurance are enough, while others insist that even small trips carry unpredictable risks.

Finally, naming the “best” travel insurance providers can be contentious. Traveler needs vary widely, and a company praised for comprehensive coverage by one person might be criticized by another for high premiums or slow claims processing.

Common Mistakes to Avoid With Your Travel Insurance

Delaying the Purchase of Insurance: It’s advisable to buy travel insurance immediately after booking your trip. This ensures coverage for unexpected cancellations or changes before departure.

Overlooking Pre-Existing Medical Conditions: Always disclose any pre-existing health issues when applying for insurance. Failure to do so can lead to claim denials related to those conditions.

Assuming All Activities Are Covered: Standard policies may not cover high-risk activities like scuba diving or skiing. If you plan to engage in such activities, ensure your policy includes them or consider purchasing additional coverage.

Choosing Based Solely on Price: While affordability is important, the cheapest policy might offer limited coverage. Evaluate the extent of coverage, deductibles, and exclusions to ensure the policy meets your needs.

Neglecting to Read the Fine Print: Understanding your policy’s terms, conditions, and exclusions is crucial. This knowledge helps prevent surprises during the claims process.

Not Considering Multi-Trip Policies: If you travel frequently, an annual multi-trip policy might be more cost-effective and convenient than purchasing separate policies for each trip.

Not Buying Travel Insurance at All

Why it’s risky:

Without insurance, you’re financially exposed to trip cancellations, medical emergencies, theft, or natural disasters.

Your U.S. health insurance likely won’t cover you abroad.

Medical evacuation can cost $20,000–$100,000+ depending on location.

What to do:

Always buy travel insurance for international trips—and consider it even for domestic ones if prepaid, nonrefundable expenses are high.

Many people wait until a few days before their trip to purchase travel insurance—but this can limit your coverage.

What you might miss:

Pre-existing condition waivers often require purchase within 14–21 days of your initial trip deposit.

Cancel for Any Reason (CFAR) upgrades are usually only available within a short time after booking your trip.

You might not be covered for unexpected events (like a sudden illness or storm) that occur before your policy starts.

Best practice:

Buy travel insurance as soon as you book your trip—ideally within 1–2 weeks of your first payment.

Not Reading the Policy Fine Print

Travel insurance policies are full of exclusions, conditions, and limitations—and not reading them can leave you unprotected when you need it most.

What to watch for:

Specific coverage limits for medical, evacuation, and baggage

Excluded activities (e.g., scuba diving, trekking above 10,000 feet, or motorcycle rentals)

Non-covered reasons for cancellation, like changing your mind or visa issues

Pro tip:

If something’s important to you—like coverage for COVID-19, natural disasters, or political unrest—make sure it’s explicitly included in writing.

Assuming Your Health Insurance Covers You Abroad

Most U.S. health insurance plans, including Medicare, don’t cover international treatment—especially not emergency evacuation.

What this means:

If you break a leg in Thailand or need an airlift from Peru, you could face massive medical bills with no safety net.

What to do:

Choose a travel insurance policy with at least $100,000 in medical coverage and $250,000+ for emergency evacuation.

Relying Only on Credit Card Insurance

Many premium credit cards offer travel protection, but the coverage is often limited.

Common credit card gaps:

No medical or evacuation coverage

Limited trip interruption/cancellation protection

Specific restrictions (must use that card to book the trip)

Best use:

Credit card insurance can be a great supplement, but not a substitute for comprehensive travel insurance.

Not Insuring the Full Trip Cost

Trip cancellation or interruption benefits typically reimburse prepaid, nonrefundable costs. But if you only insure part of your trip, you might void the full coverage.

Common example:

You insure a $1,500 flight but not your $3,000 hotel stay. If you cancel for a covered reason, the insurer may only cover what was listed—or worse, reject the claim for underinsuring.

What to do:

Always include all nonrefundable expenses when calculating your insured trip cost: flights, hotels, tours, cruises, and even prepaid transport.

Not Understanding “Covered Reasons” for Trip Cancellation

Many travelers assume they can cancel for any reason and get their money back. Not true.

Most policies only cover:

Illness or injury (with a doctor’s note)

Death in the immediate family

Job loss or jury duty

Natural disasters or terrorism at the destination

What’s not covered:

Fear of travel (e.g., due to COVID-19)

Changing your mind

Missed connections due to insufficient layovers

If you want maximum flexibility, look for a Cancel for Any Reason (CFAR) add-on, which reimburses up to 50–75% of your trip if you cancel for literally any reason—but you must meet specific conditions and pay more.

Not Adjusting the Policy for Your Destination

Not all destinations are equal—traveling to developing nations, high-altitude areas, or politically unstable regions requires extra scrutiny.

What to check:

Does the policy cover you in all countries you’re visiting?

Are there geopolitical exclusions (like certain regions in the Middle East)?

Does it include adventure activities, like trekking, scuba diving, or motorbiking?

Example:

A trip to Nepal may require high-altitude trekking coverage, which isn’t standard. Likewise, a road trip through remote parts of South America should include emergency evacuation and repatriation.

Not Keeping Documentation

Even if your claim is legitimate, it can be denied due to lack of proof.

What you need:

Original receipts and proof of payment

Medical reports and doctors’ notes

Police reports (for theft or accidents)

Flight cancellation emails or delay notices

Tip: Take pictures or digital scans and store them in the cloud for easy access while abroad.

Selecting the Best Travel Insurance

Assess Your Needs: Consider factors like trip duration, destination, planned activities, and personal health.

Compare Providers: Use comparison tools to evaluate different insurers based on coverage options, customer reviews, and pricing.

Check for Comprehensive Coverage: Ensure the policy includes medical expenses, trip cancellation, baggage loss, and other relevant protections.

Verify Exclusions: Be aware of what is not covered, such as certain high-risk activities or destinations with travel advisories.

Understand Claim Procedures: Familiarize yourself with the process for filing claims, including required documentation and timelines.

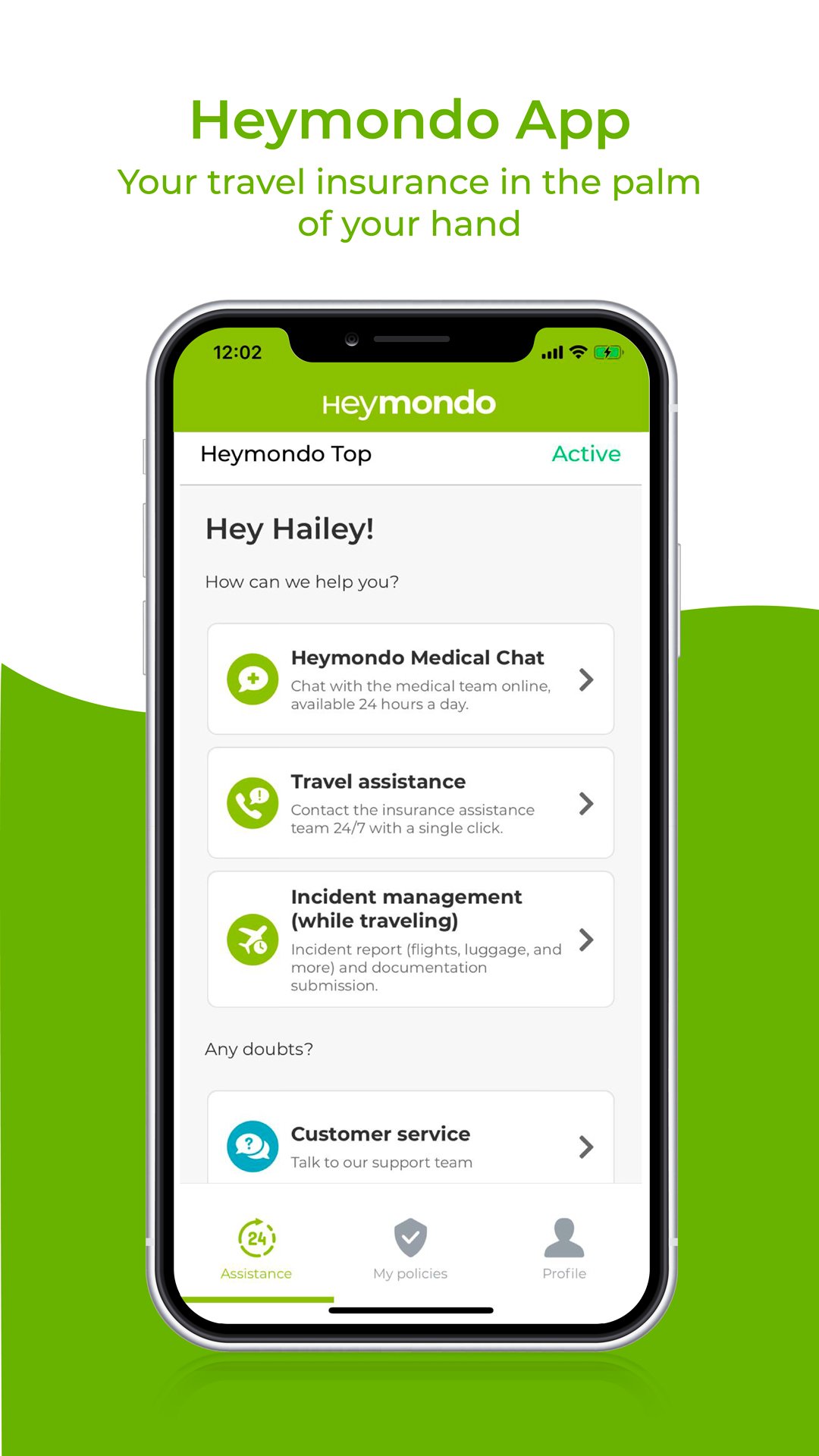

Heymondo

Heymondo positions itself as a go-to for global nomads, including expats. Its plans range from short-term travel insurance to long-term international health insurance, meaning there’s something for almost every kind of expat.

The coverage is comprehensive, with medical assistance, trip cancellation, travel delays, lost baggage, and much more included. Plus, the Heymondo app provides a direct line to assistance and an easy way to manage claims.

While not the cheapest on the market, the value proposition is strong, especially for younger, healthier expats on the move. They offer single trip, multi-trip, and long stay insurance options. This makes Heymondo a versatile choice that can adapt to various expat lifestyles.

Heymondo offers customizable travel insurance plans that can cover single trips or provide ongoing coverage, which could be ideal for expats. They also have a strong focus on easy access to healthcare services abroad, and their app provides features like immediate assistance and real-time chat with their support team. However, Heymondo’s policies may not cover some specific needs of long-term residents, like liability insurance or local health coverage.

GET HEYMONDO INSURANCE HERE W/ 15% DISCOUNTED

SafetyWing

SafetyWing, often referred to as the insurance for digital nomads, by digital nomads, also covers a range of scenarios perfect for expats. Notably, their policies are flexible and affordable, with the ability to choose your start date, end date, and pay as you go.

Coverage includes travel medical, trip interruption, lost checked luggage, travel delay, and even natural disaster benefits. SafetyWing also covers COVID-19, a crucial point in today’s world.

Ideal for digital nomads and freelancers, SafetyWing is a cost-effective choice, especially for younger expats who may not require as extensive coverage as older adults or those with families.

SafetyWing positions itself as insurance for nomads, by nomads, offering travel medical insurance for people from all over the world while outside their home country. It includes coverage for unexpected illness or injury. They offer a very flexible plan where you can choose your start date and cancel any time.

One feature that may make SafetyWing attractive to expats is that their coverage includes some amount of time in the policyholder’s home country as well, providing some peace of mind for those who travel back and forth.

Genki Travel Insurance

Genki Travel Insurance is specifically designed for expats living in Japan, making it an incredibly niche, yet valuable option. They provide extensive medical coverage, including hospitalization and surgery, as well as additional benefits such as personal liability and baggage loss.

While excellent for those based in Japan, Genki Travel Insurance won’t be the right fit for everyone. Expats living elsewhere will need to consider other options.

And, with that, we’re off to a good start. We’ll continue this in-depth analysis with Cigna Global, Allianz Care, Aetna International, and AXA – Global Healthcare. Stay tuned!

GET GENKI TRAVEL INSURANCE PLAN HERE

Final Thoughts

Travel insurance may feel like an unnecessary expense until you actually need it. The right plan can mean the difference between a minor inconvenience and a life-changing financial setback.

By understanding the fine print and avoiding common mistakes, you’ll be able to choose a policy that actually works for your type of travel—whether that’s a quick weekend getaway or a months-long journey abroad.

Ultimately, travel insurance isn’t about expecting the worst; it’s about being ready for it. When chosen wisely, it allows you to explore the world with confidence.

About the Author: Ruben, co-founder of Gamintraveler.com since 2014, is a seasoned traveler from Spain who has explored over 100 countries since 2009. Known for his extensive travel adventures across South America, Europe, the US, Australia, New Zealand, Asia, and Africa, Ruben combines his passion for adventurous yet sustainable living with his love for cycling, highlighted by his remarkable 5-month bicycle journey from Spain to Norway. He currently resides in Spain, where he continues sharing his travel experiences with his partner, Rachel, and their son, Han.